| | | | | | | | | | 22

| | |

| | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

|

| | |

| | Corporate Governance

| |

Why

| | Douglas A. Scovanner Age: 66 Director Since: November 2013 | | Prudential Committees: ● Audit ● Executive ● Risk (Chair) | | | | | | | | | Mr. Scovanner has been Founder and Managing Member of Comprehensive Financial Strategies, LLC, a management consulting firm, since October 2013. Previously, he served as CFO (1994 to 2012) and EVP (2000 to 2012) of Target Corporation (a North American retailer). Prior to joining Target Corporation, Mr. Scovanner held various management positions at The Fleming Companies, Inc., Coca-Cola Enterprises, Inc., The Coca-Cola Company and the Ford Motor Company. |

| | Michael A. Todman Age: 64 Director Since: March 2016 | | Prudential Committees: ● Compensation (Chair) ● Executive ● Finance ● Risk | | Public Directorships: ● Brown-Forman Corporation ● Carrier Global Corporation ● Mondelēz International, Inc. | | | | | | Former Directorships Held during the Past Five Years: ● Newell Brands (May 2020) | | | | | | | Mr. Todman served as Vice Chairman of the Whirlpool Corporation (Whirlpool), a global manufacturer of home appliances, from November 2014 to December 2015. Mr. Todman previously served as President of Whirlpool International from 2006 to 2007 and 2010 to 2014, as well as President, Whirlpool North America, from 2007 to 2010. Mr. Todman held several senior positions with Whirlpool over his career. | | | | | 14 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | |

| | | Corporate Governance |

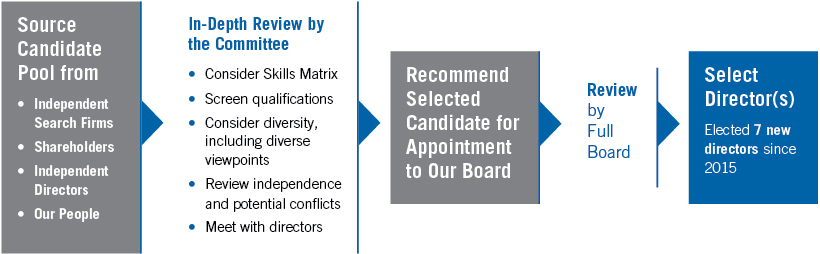

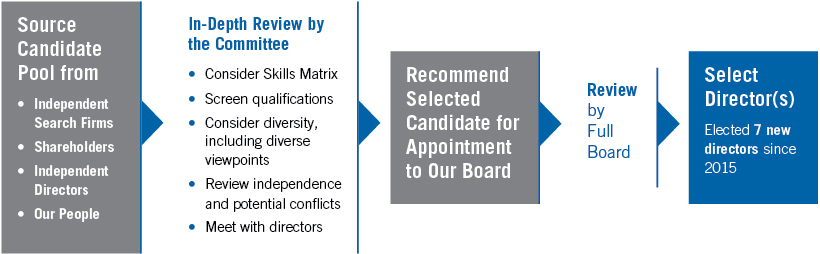

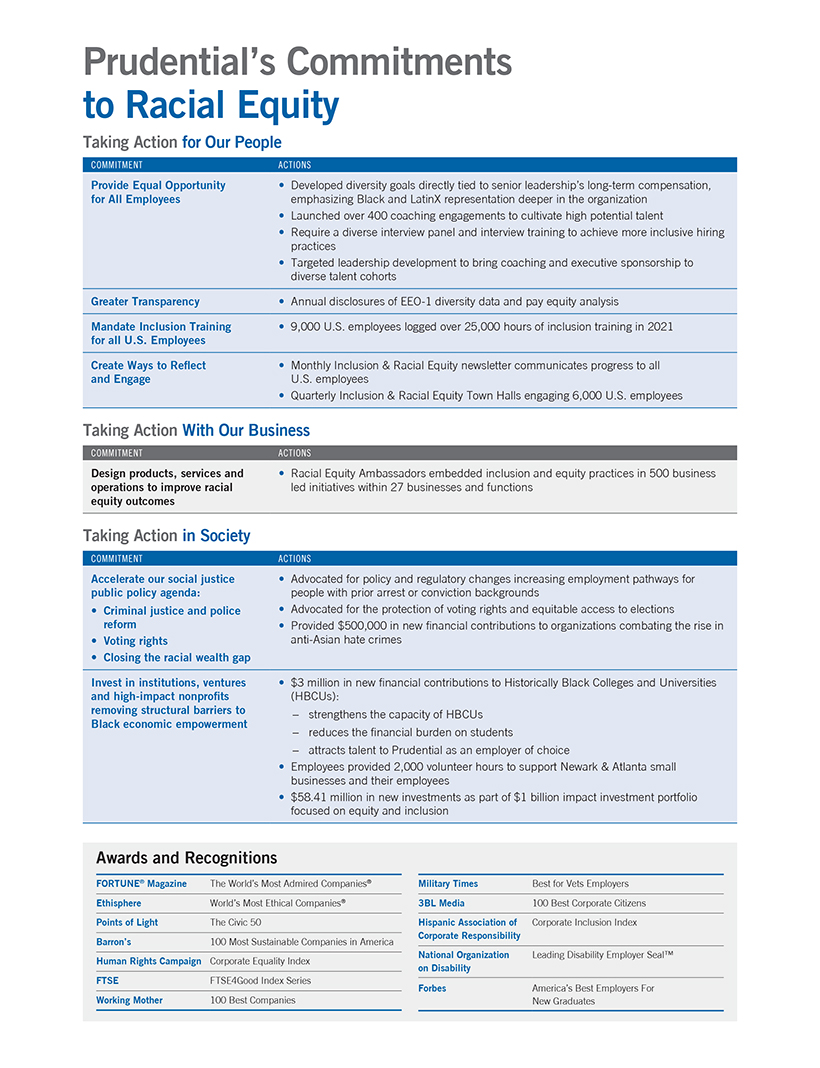

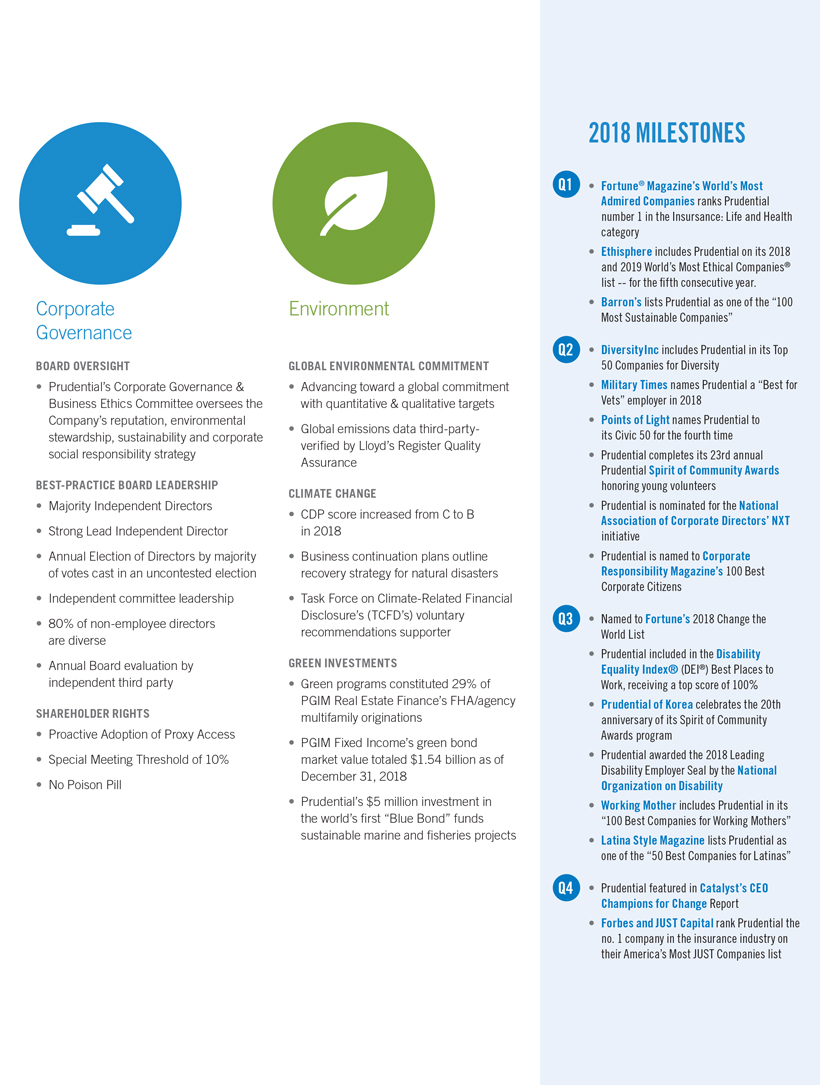

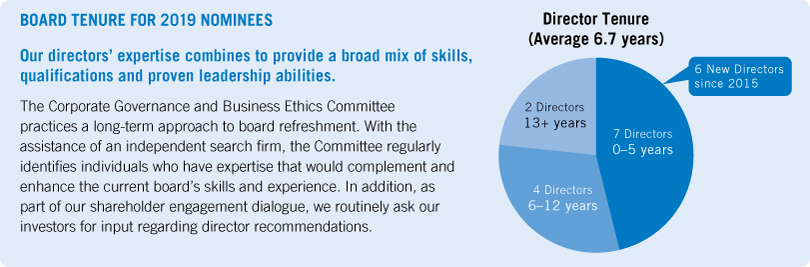

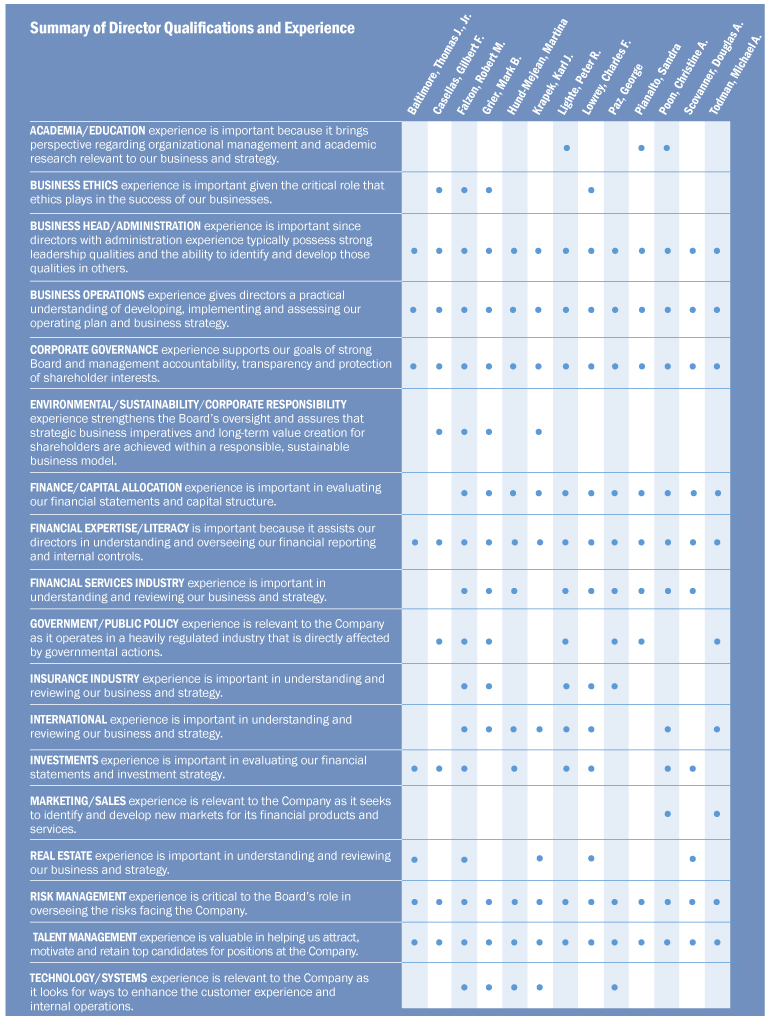

The Company is committed to good corporate governance, which helps us compete more effectively, sustain our success and build long-term shareholder value. The Company is governed by a Board of Directors and committees of the Board that meet throughout the year. Directors discharge their responsibilities at Board and committee meetings through ongoing communication with one another and management. The Board has adopted Corporate Governance Principles and Practices to provide a framework for the effective governance of the Company. The Corporate Governance Principles and Practices are reviewed regularly and updated as appropriate. The full text of the Corporate Governance Principles and Practices, which includes the definition of independence adopted by the Board, the charters of the Corporate Governance and Business Ethics, Compensation and Audit Committees, the Lead Independent Director Charter, the Code of Business Conduct and Ethics and the Related Party Transaction Approval Policy can be found at www.prudential.com/governance. Copies of these documents also may be obtained from the Chief Governance Officer and Corporate Secretary. Governance is a continuing focus at the Company, starting with the Board and extending to management and all employees. Therefore, the Board reviews the Company’s policies and business strategies and advises and counsels the CEO and other executive officers who manage the Company’s businesses, including actively overseeing and reviewing, on at least an annual basis, the Company’s strategic plans. In addition, we solicit feedback from shareholders on corporate governance and executive compensation practices, among other items, and engage in discussions with various groups and individuals on these matters. Process for Selecting Directors The Corporate Governance and Business Ethics Committee screens and recommends candidates for nomination by the full Board. The Company’s By-laws provide that the size of the Board may range from 10 to 15 members, reflecting the Board’s current view of its optimal size. The Committee is assisted with its recruitment efforts by an independent third-party search firm, which recommends candidates who satisfy the Board’s criteria. The search firm also provides research and pertinent information regarding candidates, as requested.

| | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | 15 |

| | | | | | | Corporate Governance | |

|

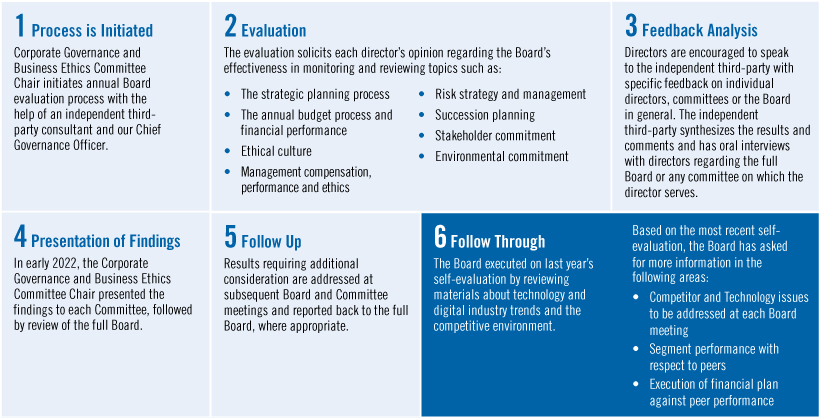

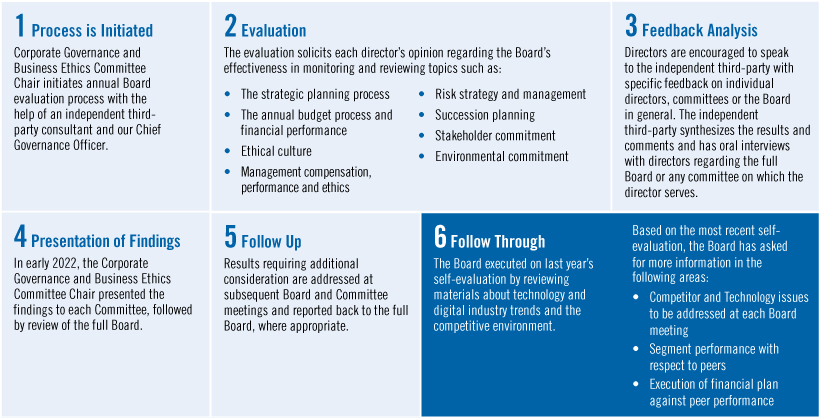

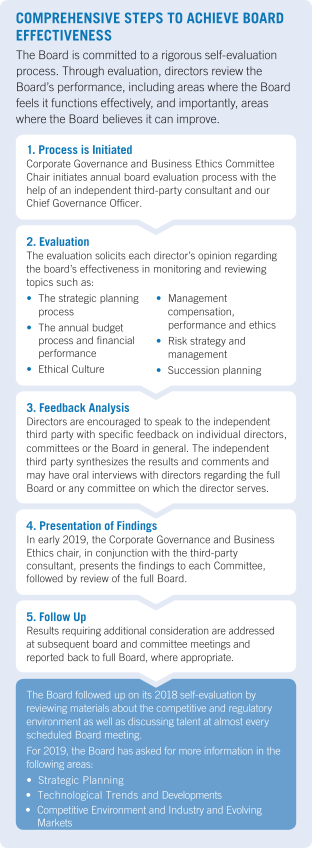

Shareholder Nominations and Recommendations of Director Candidates Our By-laws permit a group of up to 20 shareholders who have owned at least 3% of our outstanding capital stock for at least three years to submit director nominees for up to 20% of our Board seats for inclusion in our Proxy Statement if the shareholder(s) and the nominee(s) meet the requirements in our By-laws. Shareholders who wish to nominate directors for inclusion in our Proxy Statement or directly at an Annual Meeting in accordance with the procedures in our By-laws should follow the instructions under “Submission of Shareholder Proposals and Director Nominations” in this Proxy Statement. Shareholders who wish to recommend candidates for consideration should send their recommendations to the attention of Margaret M. Foran, Chief Governance Officer, Senior Vice President and Corporate Secretary, at 751 Broad Street, Newark, NJ 07102. The Committee will consider director candidates recommended by shareholders in accordance with the criteria for director selection described under “Director Criteria, Qualifications, Experience and Tenure.” Director Attendance During 2021, the Board of Directors held eleven meetings. Together, the directors attended 99% of the meetings of the full Board and the committees on which they served in 2021. Directors are expected to attend the annual meeting of shareholders. All directors at that time were present for the 2021 annual meeting of shareholders. Director Independence The current Board consists of 13 directors, two of whom are currently employed by the Company (Messrs. Lowrey and Falzon). The Board conducted an annual review and affirmatively determined that all of the non-employee directors (Mses. Hund-Mejean, Jones, Pianalto and Poon, and Messrs. Baltimore, Casellas, Krapek, Lighte, Paz, Scovanner and Todman) are “independent” as that term is defined in the listing standards of the NYSE and in Prudential’s Corporate Governance Principles and Practices. Independent Director Meetings The independent directors generally meet in an executive session at both the beginning and end of each regularly scheduled Board meeting, with the Lead Independent Director serving as Chair. Comprehensive Steps to Achieve Board Effectiveness The Board is committed to a rigorous self-evaluation process. Through evaluation, directors review the Board’s performance, including areas where the Board feels it functions effectively, and importantly, areas where the Board believes it can improve.

| | | | 16 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | | | | Corporate Governance | |

|

| | | Board Leadership Currently, our Board Structure Is Right for Prudential and its Shareholders Prudential’s Board leadership structure consists of a Lead Independent Director, a Chairman (who is reviewed byalso our CEO) and strong committee chairs. The Board believes that our structure provides independent Board leadership and engagement while providing the benefit of having our CEO, the individual with primary responsibility for managing the Company’s day-to-day operations, chair regular Board meetings as key business and strategic issues are discussed.

The Board regularly reviews its leadership structure and it thoroughly evaluated whether to continue to combine or to split the chair and CEO roles. After considering the perspectives of the independent directors, the views of our significant shareholders, voting results of recent independent chair proposals, academic research, practical experience at peer companies, and benchmarking and performance data, the Board in 2021 determined that having the same individual as both Chairman of the Board and CEO is in the best interests of the Company and its shareholders. The Board will continue to monitor the appropriateness of this structure. | | | | In 2021, our Lead Independent Director, chair of the Corporate Governance and Business Ethics Committee, regularly. Upon John Strangfeld’s retirement,Chair of the Finance Committee, Vice Chairman, Chief Human Resources Officer and our Chief Governance Officer engaged with shareholders who hold a majority of our shares on their views on our Board leadership structure, human capital management and environmental sustainability. The discussions and feedback from these meetings have been shared with the Board again gave careful deliberation toand will be considered during the Board’s annual review of the appropriateness of its structureleadership structure. |

| | | Lead Independent Director Under our Corporate Governance Principles and determined that a combined Chairman-CEO role continues to be inPractices, the best interest of our firm and shareholders. As independent directors, we believe the current structure promotes an effective Board that enables us to provide strategic guidance, challenge management’s perspectives, and meet with relevant internal and external constituents important to the Company’s operational and regulatory initiatives. The independent directors annually selectelect a Chairman of the Board and, if the individual elected as Chairman of the Board is the CEO, they also elect an independent memberdirector to serve as the Lead Independent Director. As required by the Lead Independent Director Charter, theThe Lead Independent Director is precluded from serving longergenerally expected to serve for a term of at least one year, but for no more than three consecutive years.

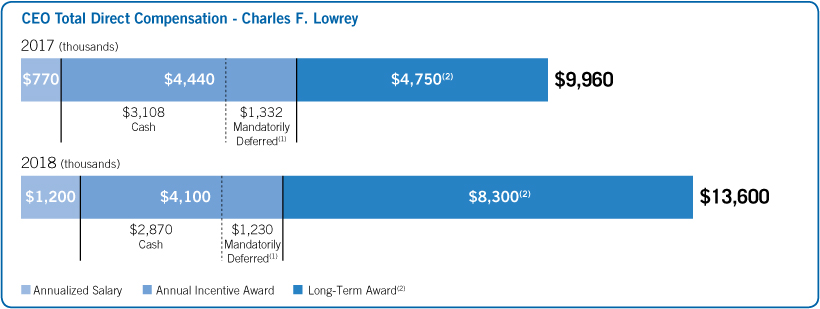

Charles Lowrey, former executive vice president and chief operating officer of Prudential’s International Businesses, was appointed CEO on December 1, 2018. He will be appointed Chairman on April 5, 2019. Charlie’s successful leadership of the Company’s asset management, U.S. and international businesses enables him to bring a broad perspective of Prudential’s operations, a deep understanding of our people, and leadership skills that will serve the Company well Ms. Poon has served as it continues to grow.

The Board believes a Chairman-CEO structure provides Prudential with a clear and effective leadership role to communicate the Company’s business and long-term strategy to its clients, shareholders and the public. The combination also provides for robust and frequent communication between the Board’s independent directors and Company management. On behalf of our shareholders, the Board is committed to advancing our momentumLead Independent Director since her initial election in the market. This transition is the result of a thoughtful, phased and long-term approach to succession planning.May 2020.

Lead Independent Director:Key Responsibilities

| ●Calls meetings of the independent directors directors.● Presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors. ●Facilitates communication between the independent directors and our Chairman Chairman.●Provides independent Board leadership leadership.●Elected annually toand may serve no more than three years Setsyears.● Approves the agenda for all Board meetings and approves all Board material materials.●Communicates with shareholders and other key constituents, as appropriate | | ●Meets directly with the management andnon-management employees of our firm firm.●Engages with our other independent directors to identify matters for discussion at executive sessions of independent directors and advises our Chairman of any decisions reached, and suggestions made at the executive sessions sessions.●In collaboration with the Corporate Governance and Business Ethics Committee, addresses Board effectiveness, performance and composition composition.●Authorized to retain outside advisors and consultants who report directly to the Board on Board-wide issues | Culture at Prudential

At Prudential, nearly 50,000 employees from around the globe bring their diverse backgrounds and perspectives to work every day in

pursuit of the company’s shared purpose: making lives better by solving the financial challenges of a changing world.

Drawing on a wide range of expertise and experience across a multitude of disciplines, we are bound by our commitment to what we do

and how we work together.

This means that culture is a unique differentiator and a long-term competitive advantage for Prudential. It fuels our ability to execute in differentiated ways and is a critical underpinning of our talent strategy.

Therefore, we invest in understanding and developing our culture. We want to ensure that it is as inclusive and collaborative as it can be, and that it supports how we compete in an evolving marketplace.

In July 2018, Prudential asked thousands of employees across the United States to share their vision for our culture and for Prudential. Solicited in a spirit of candor and continual improvement, the results provided valuable guidance for our approach to business challenges and talent opportunities. These results were shared with the Board of Directors and senior leadership, and the feedback will help the company support a fully inclusive culture that unlocks the best-in-class execution, collaboration, and performance of our talent.issues.

|

| | | | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | 17 |

| | | | | | | Corporate Governance | |

|

Shareholder Engagement at Prudential

| Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

| | |

| | 23

| | 18 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | | | |

| Corporate Governance | |

|

|

A Message to Our Shareholders from Prudential’s Lead Independent Director, Christine A. Poon As your Lead Independent Director, it is an honor to work with our Board on behalf of Prudential’s stakeholders. This past year, the Company made significant progress against our transformation strategy for long-term growth even as we all continue to navigate the unprecedented challenges of the pandemic. Through it all, we have been guided by our commitment to making lives better by solving the financial challenges of our ever-changing world. The Board continues to be agile, adapting to changing circumstances. I attribute this to our directors’ skills, varied experiences, and diversity. Our 13 directors maintain broad and deep experience in strategy development, operational excellence, human capital and culture, sustainability, finance, and other important areas that are directly relevant to Prudential’s strategic priorities. In addition to bringing important skills, our Board members represent a wide range of backgrounds and individual experiences, which we believe are reflective of our global operations and diverse consumer base. Of our 13 director nominees, 11 are independent. Eighty two percent of our independent directors are diverse. Our average Board tenure is approximately nine years. We are proud of the continuing evolution of our Board and track record of refreshment. Regular shareholder feedback informs the Board’s thinking and allows us to continually broaden our perspective. I met with a number of our institutional investors throughout 2021. Our dialogue covered a broad range of topics, including the Board’s diverse composition and breadth of experience, the role of the Lead Independent Director, the Board’s oversight of our Company’s transformation strategy, our Company’s environmental commitment and commitment to stakeholders, and the Board’s oversight of our human capital and diversity initiatives. Investors’ viewpoints are shared with the entire Board, enhancing our decision-making. To enable shareholders to hear directly from our Board, we continue to release director video interviews in conjunction with our proxy statement. This year, we are featuring Wendy E. Jones, member of the Board’s Audit Committee, Gilbert F. Casellas, Chairman of Prudential’s Corporate Governance and Business Ethics Committee, and Robert Falzon, our Vice Chairman. While more work lies ahead, we are pleased with the Company’s progress against our transformation objectives. The Board recognizes that continued strong performance requires vigilant focus on our core business principles, including exceptional client service, operational excellence, and a culture that cultivates strong performing teams. Through our oversight of the Company’s strategic planning process, the Board and management are accountable for abiding by these principles. On behalf of the Board, thank you for your continuing trust and investment in Prudential. Christine A. Poon Lead Independent Director | | | Corporate Governance

|

Christine A. Poon Prudential Lead Independent Director | | Ms. Poon was elected by Prudential’s independent directors to serve as Lead Independent Director effective May 12, 2020. She brings significant experience and knowledge to the Lead Independent Director role. Ms. Poon has served as a Prudential director since 2006. She currently chairs the Executive and Finance Committees and sits on the Investment and Risk Committees. Due to her Board experience and leadership, Ms. Poon understands the Company’s long-term strategic priorities. In addition, she possesses a deep understanding of Prudential and its industry’s legal, regulatory, and competitive frameworks. |

| Board Risk Oversight

The Board oversees the Company’s risk profileCulture at Prudential

Remote work arrangements for most employees in 2021 continued to present a challenging landscape for workplace culture, but Prudential has continued to connect our workforce by building engagement programs that inspire our employees to live our purpose and management’s processesembrace virtual team environments. These programs included new pro bono opportunities for assessingour Business Resource Groups to solve challenges for nonprofits while simultaneously building their skills and managing risk, through both the whole Board and through its committees. At least annually, the Board reviews strategic risks and opportunities facing the Company and certain of its businesses. Other important categories of risk are assigned to designated Board committees that report backconnecting them to the full Board. In general,company’s purpose. Another new engagement platform called Missions enables multi-faceted, virtual opportunities focused on topics such as health & wellness, civic engagement and sustainability, based on employee interests. Additionally, to help prepare for our hybrid workplace of the committees oversee the following risks:future, we equipped leaders with resources, tip sheets and presentations focused on creating behaviors that allow all five of our cultural aspirations—customer obsessed, outcomes driven, risk smart, tech forward and inclusive—to serve as guides towards creating a high-performing workplace where employees feel valued and interconnected. Audit Committee:insurance risk and operational risks, including model risk, as well as risks related to financial controls, legal, regulatory and compliance risks, and the overall risk management governance structure and risk management function;

|

| | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | 19 |

| | | | | | | Compensation Committee:Corporate Governancethe design and operation of the Company’s compensation programs so that they do not encourage unnecessary or excessive risk-taking;

| |

|

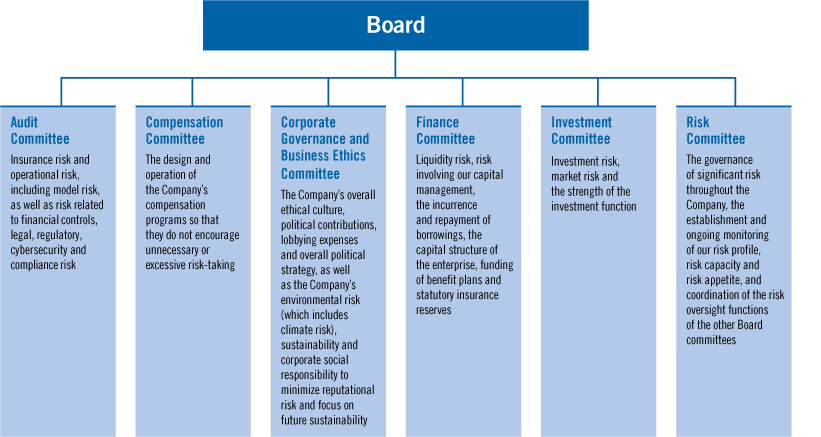

Board Risk Oversight The Board oversees the Company’s risk profile and management’s processes for assessing and managing risk, through both the whole Board and its committees. At least annually, the Board reviews strategic risks and opportunities facing the Company and its businesses. Other important categories of risk are assigned to designated Board committees that report back to the full Board. In general, the committees oversee the following risks:  In performing its oversight responsibilities, the Board and its committees review policies and guidelines that senior management uses to manage the Company’s exposure to material categories of risk. As these issues sometimes overlap, Board committees hold joint meetings when appropriate and address certain issues at the full Board level. During 2021, the Risk Committee received updates from the Chief Risk Officer on the important strategic issues and risks facing the Company, including a discussion on the Own Risk and Solvency Assessment (“ORSA”) and the Company’s current and future initiatives to address climate and environmental related risks. In addition, the Board and committees review the performance and functioning of the Company’s overall risk management function. The Risk Committee currently includes the chairs of each of the other Board committees as well as another independent director who serves as Chair of the Committee. The principal activities of the Risk Committee are to: oversee the Company’s assessment and reporting of material risks by reviewing the metrics used by management to quantify risk, applicable risk limit structures and risk mitigation strategies; review the Company’s processes and procedures for risk assessment and risk management, including the related assumptions used across the Company’s businesses and material risk types; and receive reports from management on material and emerging risk topics that are reviewed by the Company’s internal management committees. The Company, under the Board’s oversight, is organized to promote a strong risk awareness and management culture. The Chief Risk Officer sits on many management committees and heads an independent enterprise risk management department; the General Counsel and Chief Compliance Officer also sit on key management committees and the functions they oversee operate independently of the businesses to separate management and oversight. Also, our employees are evaluated with respect to risk and ethics. | | | | 20 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | | | | Corporate Governance and Business Ethics Committee:the Company’s overall ethical culture, political contributions, lobbying expenses and overall political strategy, as well as the Company’s environmental risk (which includes climate risk), sustainability and corporate social responsibility to minimize reputational risk and focus on future sustainability; | | Finance Committee:liquidity risk, risks involving our capital management, the incurrence and repayment of borrowings, the capital structure of the enterprise, funding of benefit plans and statutory insurance reserves;

Investment Committee:investment risk, market risk and the strength of the investment function; and

Risk Committee:the governance of significant risks throughout the Company, the establishment and ongoing monitoring of our risk profile, risk capacity and risk appetite, and coordination of the risk oversight functions of the other Board committees.

In performing its oversight responsibilities, the Board and its committees review policies and guidelines that senior management uses to manage the Company’s exposure to material categories of risk. As these issues sometimes overlap, Board committees hold joint meetings when appropriate and address certain issues at the full Board level. During 2018, the Risk Committee received an update from the Chief Risk Officer on the important strategic issues and risks facing the Company. In addition, the Board and committees review the performance and functioning of the Company’s overall risk management function.

The Risk Committee is comprised of the chairs of each of the other Board committees and Mark Grier, our Vice Chairman, who supervises the Chief Risk Officer of the Company. The principal activities of the Risk Committee are to: oversee the Company’s assessment and reporting of material risks by reviewing the metrics used by management to quantify risk, applicable risk limit structures and risk mitigation strategies; review the Company’s processes and procedures for risk assessment and risk management, including the related assumptions used across the Company’s businesses and material risk types; and receive reports from management on material and emerging risk topics that are reviewed by the Company’s internal management committees.

The Company, under the Board’s oversight, is organized to promote a strong risk awareness and management culture. The Chief Risk Officer sits on many management committees and heads an independent enterprise risk management department; the General Counsel and Chief Compliance Officer also sit on key management committees and the functions they oversee operate independently of the businesses to separate management and oversight. Employee appraisals evaluate employees with respect to risk and ethics.

Cybersecurity Risk Oversight

In addition, the Board oversees the Company’s cyber risk management

|

Cybersecurity Risk Oversight In addition, the Board oversees the Company’s Information Security program. In order to respond to the threat of security breaches and cyberattacks, we have developed a program, overseen by the Company’s Chief Information Security Officer and our Information Security Office, that is designed to protect and preserve the confidentiality, integrity and continued availability of all information owned by, or in the care of, the Company. This program also includes a cyber incident response plan that provides controls and procedures for timely and accurate reporting of any material cybersecurity incident. Prudential has not had a material data security breach in three years. The Audit Committee, which is tasked with oversight of certain risk issues, including cybersecurity, receives reports from the Chief Information Security Officer, the Chief Information Officer and the Global Head of Operational Risk throughout the year. At least annually, the Board and the Audit Committee also receive updates about the results of program reviews, including exercises and response readiness assessments led by outside advisors who provide a third-party independent assessment of our technical program and internal response preparedness. The Audit Committee regularly briefs the full Board on these matters, and the full Board also receives periodic briefings on cyber threats in order to enhance our directors’ literacy on cyber issues. Cybersecurity Governance Highlights | ● | | Comprehensive reporting to our Board and Risk Committee by our Chief Information Security Officer and our Information Security Office that is designedin response to protect and preserve the confidentiality, integrity and continued availability of all information owned by, or in the care of, the Company. This program also includes a cyber incident response plan that provides controls and procedures for timely and accurate reporting of any material cybersecurity incident. The Audit Committee, which is tasked with oversight of certain risk issues, including cybersecurity, receives periodic reports from the Chief Information Security Officer, the Chief Information Officer and the Head of Operational Risk. The Board and the Audit Committee also periodically receive updates about the results of exercises and response readiness assessments led by outside advisors who provide a third-party independent assessment of our technical program and our internal response preparedness. The Audit Committee regularly briefs the full Board on these matters, and the full Board also receives periodic briefings on cyber threats in order to enhance our directors’ literacy on cyber issues. | | | | | | | | 24

| | |

| | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

|

| | |

| | Corporate Governance

| key developments |

| ● | | Executive CompensationCross-functional approach to addressing cybersecurity risk, with Global Technology & Operations, Risk, OversightLegal, and Corporate Audit functions presenting on key topics

|

| ● | | We monitor the risks associatedGlobal presence with 24/7 cyber threat operations centers

|

| ● | | All employees with access to our compensation programsCompany’s systems receive comprehensive annual training on responsible information security, data security, and individual executive compensation decisions on an ongoing basis. Each year, management undertakes a review of the Company’s various compensation programscybersecurity practices and how to assess the risks arising fromprotect data against cyber threats |

| ● | | Relevant cybersecurity controls related to financial reporting are considered by our compensation policies and practices. Management presents these risk assessments to the Compensation Committee. The risk assessments have included a review of the primary design features of the Company’s compensation plans, the process to determine compensation pools and awards for employees and an analysis of how those features could directly or indirectly encourage or mitigate risk-taking. As part of the risk assessments, it has been noted that the Company’s compensation plans allow for discretionary negative adjustments to the ultimate outcomes, which serves to mitigate risk-taking. Moreover, senior management is subject to share ownership and retention policies, and historically a large percentage of senior management compensation has been paidexternal auditor in the formcontext of Prudential’s annual external integrated audit

|

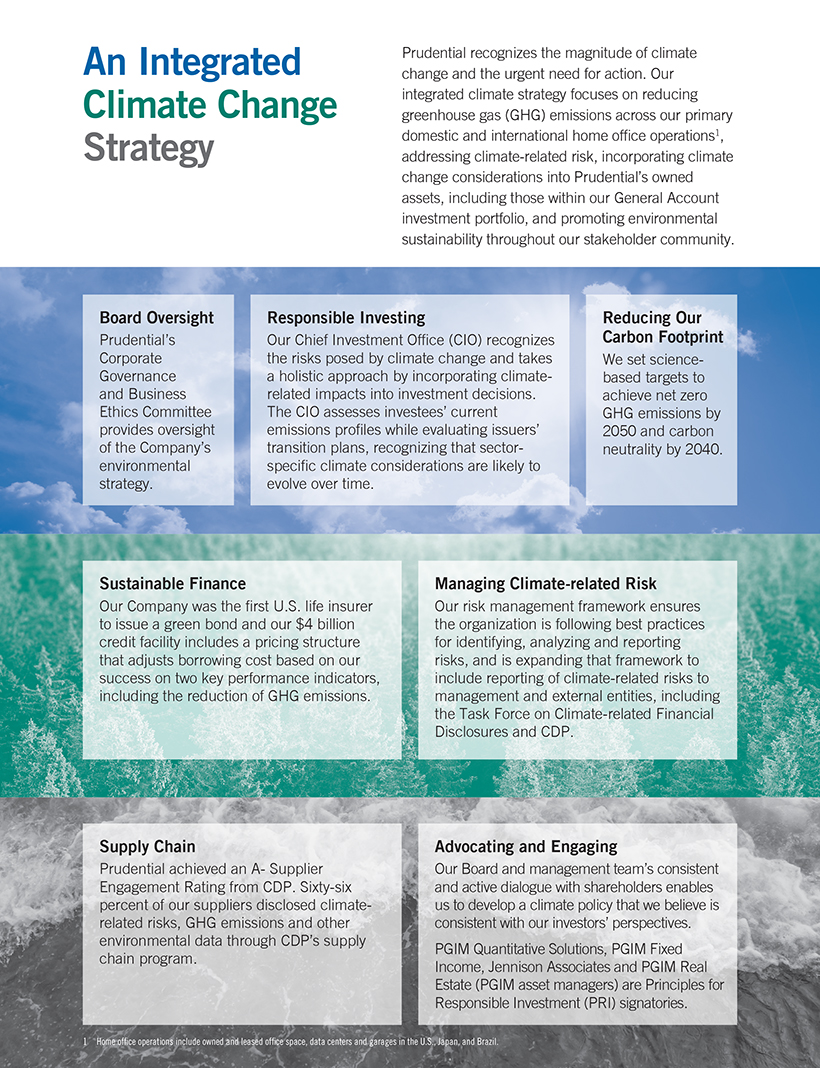

Executive Compensation Risk Oversight We monitor the risks associated with our compensation programs and individual executive compensation decisions on an ongoing basis. Each year, management undertakes a review of the Company’s various compensation programs to assess the risks arising from our compensation policies and practices. Management presents these risk assessments to the Compensation Committee. The risk assessments have included a review of the primary design features of the Company’s compensation plans, the process to determine compensation pools and awards for employees and an analysis of how those features could directly or indirectly encourage or mitigate risk-taking. As part of the risk assessments, it has been noted that the Company’s annual incentive plan allows for discretionary negative adjustments to the ultimate outcomes, which serves to mitigate risk-taking. Moreover, senior management is subject to share ownership and retention policies, and historically, a large percentage of senior management compensation has been paid in the form of long-term equity awards. In addition, senior management compensation is paid over a multiple-year cycle, a compensation structure that is intended to align incentives with appropriate risk-taking. The Company’s general risk management controls also serve to preclude decision-makers from taking excessive risk to earn the incentives provided under our compensation plans. The Compensation Committee agreed with the conclusion that the identified risks were within our ability to effectively monitor and manage, and that our compensation programs do not encourage unnecessary or excessive risk-taking and do not create risks that are reasonably likely to have a material adverse effect on the Company. Environmental Sustainability Environmental Sustainability is overseen by the Board of Directors and its Corporate Governance and Business Ethics Committee. The Company’s sustainability strategy is led by Prudential’s senior leaders, including Prudential’s Vice Chairman, as the enterprise wide sustainability Executive Sponsor. The Corporate Governance and Business Ethics Committee discusses environmental sustainability, ESG and climate objectives and strategy at least quarterly. This regular engagement gives the Board insight into the Company’s climate change strategy and environmental stewardship initiatives. In addition, the full Board also receives periodic briefings and education on core concepts and trends that impact our businesses and society as well as regular discussions in the Investment and Risk Committees. The Company also has a Climate Change Steering Committee, led by Prudential’s Vice Chairman, that guides climate policy for the enterprise. In November 2021, we announced our commitment to achieve net-zero emissions across our primary domestic and international home office operations by 2050. To accelerate the Company’s longstanding commitment to mitigate the impacts of climate change, we also set an interim goal to become carbon neutral by 2040. These actions are aligned with the latest climate science of limiting global warming to 1.5 degrees Celsius or lower, as specified in the Paris Climate Accord. | | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | 21 |

| | | | | | | Succession PlanningCorporate Governance

| | The Board is actively engaged and involved in talent management. The Board reviews the Company’s “people strategy” in support of its business strategy at least annually and frequently discusses talent issues at its meetings. This includes a detailed discussion of the Company’s global leadership bench and succession plans with a focus on key positions at the senior officer level. As a result of this approach, the Board was well positioned to execute on its succession plan in 2018, including the appointment of Mr. Lowrey to succeed Mr. Strangfeld as CEO and Chairman and Mr. Falzon to succeed Mr. Grier as Vice Chairman.

In addition, the committees of the Board regularly discuss the talent pipeline for specific critical roles. High-potential

|

Human Capital Management and Succession Planning The Board believes that human capital management and succession planning, including inclusion and diversity, are paramount to the Company’s success and central to our long-term strategy. Our Company’s Corporate Social Responsibility Oversight Committee, comprising Board members and Prudential senior executives, in addition to the full Board, evaluates the Company’s commitment to inclusion and diversity and actively suggests policy enhancements. The Board has primary responsibility for CEO succession planning. In addition, the Board reviews the Company’s “people strategy” in support of its business strategy at least annually and frequently discusses talent issues at its meetings. This includes a detailed discussion of the Company’s global leadership bench and succession plans with a focus on key positions at the senior officer levels. In support of our commitment to talent development, throughout the year, high-potential leaders are given exposure and visibility to Board members through formal presentations and at informal events. This engagement gives the Board insight into the Company’s talent pool and our leaders’ succession plans. More broadly, the Board is regularly updated on key talent indicators for the overall workforce, including diversity, recruiting and development programs. Preliminary 2021 Consolidated U.S. Employer Information Report (EEO-1) The summary table below displays Prudential’s U.S. workforce by EEO-1 job category as of December 31, 2021. The preliminary results in the table are supplied in advance of the official EEO-1 filing, which will be filed in April 2022. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Male | | | | Female | | | | SECTION D - EMPLOYMENT DATA JOB CATEGORIES | | Hispanic or Latino | | | | | | Native

Hawaiian

or Other

Pacific Islander | | | | | | Two or

more races | | | | | | | | Native

Hawaiian

or Other

Pacific Islander | | | | | | Two or

more races | | | | | Male | | Female | | White | | Black | | Asian | | Indian | | White | | Black | | Asian | | Indian | | Total | | | | | | | | | | | | | | | | | | | Executive/Senior Level Officials and Managers | | | | 23 | | | | | 9 | | | | | 336 | | | | | 15 | | | | | 0 | | | | | 44 | | | | | 0 | | | | | 3 | | | | | | | | | | 162 | | | | | 13 | | | | | 0 | | | | | 23 | | | | | 0 | | | | | 4 | | | | | 632 | | | | | | | | | | | | | | | | | | | First/Mid-Level Officials and Managers | | | | 150 | | | | | 93 | | | | | 2,269 | | | | | 105 | | | | | 5 | | | | | 519 | | | | | 3 | | | | | 35 | | | | | | | | | | 1,345 | | | | | 117 | | | | | 5 | | | | | 352 | | | | | 6 | | | | | 25 | | | | | 5,029 | | | | | | | | | | | | | | | | | | | Professionals | | | | 241 | | | | | 313 | | | | | 2,084 | | | | | 220 | | | | | 9 | | | | | 459 | | | | | 1 | | | | | 56 | | | | | | | | | | 2,746 | | | | | 550 | | | | | 8 | | | | | 492 | | | | | 4 | | | | | 68 | | | | | 7,251 | | | | | | | | | | | | | | | | | | | Sales Workers | | | | 73 | | | | | 44 | | | | | 655 | | | | | 131 | | | | | 1 | | | | | 53 | | | | | 7 | | | | | 31 | | | | | | | | | | 302 | | | | | 119 | | | | | 1 | | | | | 46 | | | | | 5 | | | | | 32 | | | | | 1,500 | | | | | | | | | | | | | | | | | | | Administrative Support Workers | | | | 83 | | | | | 226 | | | | | 365 | | | | | 101 | | | | | 1 | | | | | 26 | | | | | 0 | | | | | 7 | | | | | | | | | | 965 | | | | | 368 | | | | | 2 | | | | | 64 | | | | | 5 | | | | | 52 | | | | | 2,265 | | | | | | | | | | | | | | | | | | | Service Workers | | | | 4 | | | | | 4 | | | | | 8 | | | | | 7 | | | | | 0 | | | | | 0 | | | | | 0 | | | | | 0 | | | | | | | | | | 1 | | | | | 0 | | | | | 0 | | | | | 0 | | | | | 0 | | | | | 0 | | | | | 24 | | | | | | | | | | | | | | | | | | | TOTAL | | | | 574 | | | | | 689 | | | | | 5,717 | | | | | 579 | | | | | 16 | | | | | 1,101 | | | | | 11 | | | | | 132 | | | | | | | | | | 5,521 | | | | | 1,167 | | | | | 16 | | | | | 977 | | | | | 20 | | | | | 181 | | | | | 16,701 | |

Communication with Directors Shareholders and other interested parties may communicate with any of the independent directors, including Committee Chairs and the Lead Independent Director, by using the following address: Prudential Financial, Inc. Board of Directors c/o Margaret M. Foran, Chief Governance Officer, Senior Vice President and Corporate Secretary 751 Broad Street Newark, NJ 07102 Email: independentdirectors@ prudential.com Feedback on Executive Compensation: You can also provide feedback on executive compensation at the following website: www.prudential.com/ executivecomp.

The Chief Governance Officer, Senior Vice President and Corporate Secretary of the Company reviews communications to the independent directors and forwards those communications to the independent directors as discussed below. Communications involving substantive accounting or auditing matters will be immediately forwarded to the Chair of the Audit Committee and the Company’s Corporate Chief Ethics Officer consistent with time frames established by the Audit Committee for the receipt of communications dealing with these matters. Communications that pertain tonon-financial matters will be forwarded promptly. Items that are unrelated to the duties and responsibilities of the Board will not be forwarded, such as: business solicitationsolicitations or advertisements; product-related inquiries; junk mail or mass mailings; resumes or otherjob-related inquiries; or spam and overly or overtly hostile, threatening, potentially illegal or similarly unsuitable communications. Feedback on Executive Compensation: You can also provide feedback on executive compensation at the following website: www.prudential.com/ executivecomp. | | | | 22 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

| | |

| | 25

|

| | |

| | Corporate Governance | |

|

Committees of the Board of Directors The Board has established various committees to assist in discharging its duties, including: Audit, Compensation, Corporate Governance and Business Ethics, Executive, Finance, Investment and Risk. The primary responsibilities of each of the committees are set forth below, together with their current membership and the number of meetings held in 2018.2021. Committee charters can be found on our website at www.prudential.com/governance. Each member of the Audit, Compensation, and Corporate Governance and Business Ethics Committees has been determined by the Board to be independent for purposes of the NYSE Corporate Governance listing standards. In addition, directors who serve on the Audit Committee and the Compensation Committee meet additional, heightened independence and qualification criteria applicable to directors serving on these committees under the NYSE listing standards. | | | | | | | Committees | | Current Members in 2018 | | Description | | | | | | | Audit Committee Meetings in 2018:2021: 10 | | Martina-Hund Mejean (Chair) Wendy E. Jones Douglas A. Scovanner (Chair) Martina-Hund Mejean

George Paz | | The Audit Committee provides oversight of the Company’s accounting and financial reporting and disclosure processes, the adequacy of the systems of disclosure and internal control established by management, and the audit of the Company’s financial statements. The Audit Committee oversees insurance risk and operational risks, risks related to financial controls, and legal, regulatory, cybersecurity and compliance matters, and oversees the overall risk management governance structure and risk management function. | | Among other things, the Audit Committee: (1) appoints the independent auditor and evaluates its qualifications, independence and performance; (2) reviews the audit plans for and results of the independent audit and internal audits; and (3) reviews reports related to processes established by management to provide compliance with legal and regulatory requirements. The Board has determined that all of our Audit Committee members are financially literate and are audit committee financial experts as defined by the SEC. | | | | Compensation Committee Meetings in 2018: 72021: 6 | | Karl J. KrapekMichael A. Todman (Chair)

Thomas J. Baltimore Michael A. TodmanKarl J. Krapek

| | The Compensation Committee oversees the Company’s compensation and benefits policies and programs. For more information on the responsibilities and activities of the Compensation Committee, including the Committee’s processes for determining executive compensation, see the CD&A. | | | | Corporate Governance Governance & Business Ethics Committee

Meetings in 2018:2021: 7 | | Gilbert F. Casellas (Chair) Peter R. Lighte Sandra Pianalto | | The Corporate Governance and Business Ethics Committee oversees the Board’s corporate governance procedures and practices, including the recommendations of individuals for the Board, making recommendations to the Board regarding director compensation and overseeing the Company’s ethics and conflict of interestconflict-of-interest policies, its political contributions and lobbying expenses policy, and its strategy and reputation regarding ESG issues, including environmental stewardship, sustainability, climate, human capital management issues, including inclusion and diversity, and corporate social responsibility throughout the Company’s global businesses. | | | | Executive Committee(1) Meetings in 2018:2021: 0 | | Christine A. Poon (Chair) Thomas J. Baltimore (Chair) Gilbert F. Casellas Karl J. KrapekMartina Hund-Mejean

Charles F. Lowrey Christine A. Poon

Douglas A. Scovanner John R. StrangfeldMichael A. Todman

| | The Executive Committee is authorized to exercise the corporate powers of the Company between meetings of the Board, except for those powers reserved to the Board by ourBy-laws or otherwise. | | | | Finance Committee Meetings in 2018: 52021: 6 | | Christine A. Poon (Chair) George Paz Sandra Pianalto Michael A. Todman | | | | The Finance Committee oversees, takes actions, and approves policies with respect to capital, liquidity, borrowing levels, reserves, benefit plan funding and major capital expenditures. | | | | Investment

Committee

Meetings in 2018:2021: 4 | | Thomas J. Baltimore (Chair) Peter R. Lighte Christine A. Poon | | The Investment Committee oversees and takes actions with respect to the acquisition, management and disposition of invested assets; reviews the investment performance of the pension plan and funded employee benefit plans; and reviews investment risks and exposures, as well as the investment performance of products and accounts managed on behalf of third parties. | | | | Risk Committee Meetings in 2018:2021: 5 | | Douglas A. Scovanner (Chair) Thomas J. Baltimore (Chair) Gilbert F. Casellas Mark B. Grier

Karl J. KrapekMartina Hund-Mejean

Christine A. Poon DouglasMichael A. ScovannerTodman

| | The Risk Committee oversees the governance of significant risks throughout the enterprise by coordinating the risk oversight functions of each Board committee and seeing that matters are appropriately elevated to the Board. |

(1) | Charles Lowrey was elected to the Executive Committee on January 25, 2019

|

In addition to the above Committee meetings, the Board held eighteleven meetings in 2018.2021. | | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | 23 |

| | | | | | | | 26

| | |

Corporate Governance | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement |

| | |

| | Corporate Governance

|

|

Certain Relationships and Related Party Transactions The Company has adopted a written Related Party Transaction Approval Policy that applies: to any transaction or series of transactions in which the Company or a subsidiary is a participant;

| ● | | to any transaction or series of transactions in which the Company or a subsidiary is a participant; |

when the amount involved exceeds $120,000; and

| ● | | when the amount involved exceeds $120,000; and |

when a related party (a director or executive officer of the Company, any nominee for director, any shareholder owning an excess of 5% of the total equity of the Company and any immediate family member of any such person) has a direct or indirect material interest (other than solely as a result of being a director or trustee or in any similar position or a less than 10% beneficial owner of another entity).

| ● | | when a related party (a director or executive officer of the Company, any nominee for director, any shareholder owning an excess of 5% of the total equity of the Company and any immediate family member of any such person) has a direct or indirect material interest (other than solely as a result of being a director or trustee or in any similar position or a less-than-10% beneficial owner of another entity). |

The policy is administered by the Corporate Governance and Business Ethics Committee. The Committee, which will consider relevant facts and circumstances in determining whether or not to approve or ratify such a transaction, and will approve or ratify only those transactions that are, in the Committee’sits judgment, appropriate or desirable under the circumstances. In the ordinary course of business, we may from time to time engage in transactions with other corporations or financial institutions whose officers or directors are also directors of Prudential Financial. In all cases, these transactions are conducted on anarm’s-length basis. In addition, from time to time executive officers and directors of Prudential Financial may engage in transactions in the ordinary course of business involving services we offer, such as insurance and investment services, on terms similar to those extended to employees of Prudential Financial and its subsidiaries and affiliates generally. The Corporate Governance and Business Ethics Committee has determined that certain types of transactions do not create or involve a direct or indirect material interest, including (i) any sales of financial services or products to a related party in the ordinary course of business on terms and conditions generally available in the marketplace (or at ordinary employee discounts, if applicable) and in accordance with applicable law and (ii) all business relationships between the Company and a 5% shareholder or a business affiliated with a director, director nominee or immediate family member of a director or director nominee made in the ordinary course of business on terms and conditions generally available in the marketplace and in accordance with applicable law. Pursuant to our policy, the Corporate Governance and Business Ethics Committee determined that there were threetwo transactions that qualifiedqualify as related party transactions since the beginning of 2018. The2021: Brett Sleyster, the son of Scott Sleyster, our Executive Vice President and Head of International Businesses, is employed as an Associate for PruVen Capital Partners GP, LLC (“PruVen Capital’’) and performs services for PruVen Capital and other affiliated and associated entities. Prudential provides 99% of PruVen Capital’s investable capital. Over a contract term of sixteen months, Brett Sleyster’s total expected compensation will be less than $190,000 and is similar to the compensation of other employees holding equivalent positions. Michael F. Falzon, the brother of Robert M. Falzon, our Vice Chairman, Michael F. Falzon, is ouremployed as a Vice President, Infrastructure Systems Development.Information Systems. In 2018,2021, the total compensation paid to Michael Falzon, including salary, bonus and the grant date value of long-term incentive awards, was approximately $600,000. Theson-in-law of Barbara Koster, our Senior Vice President and Chief Information Officer, Joshua D. Howard,less than $540,000. Michael Falzon’s compensation is an associate in Quantitative Management Associates, a subsidiary of the Company. In 2018, the total compensation paid to Mr. Howard, including salary and bonus, was approximately $165,000. The daughter of Timothy L. Schmidt, our Senior Vice President and Chief Investment Officer, Carley J. Berger, is an associate in the actuarial department. In 2018, the total compensation paid to Ms. Berger, including salary and bonus, was approximately $130,000. In all three cases, the individuals’ compensation was similar to the compensation of other employees holding equivalent positions. | | | | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

| | |

| | 27

|

| | |

| | Corporate Governance

| |

Policy on Shareholder Rights Plan We do not have a shareholder rights plan. The Board will obtain shareholder approval prior to adopting a future shareholder rights plan unless the Board, in the exercise of its fiduciary duties, determines that under the circumstances then existing, it would be in the best interests of the Company and our shareholders to adopt a rights plan without prior shareholder approval. If a rights plan is adopted by the Board without prior shareholder approval, the plan must provide that it will expire within one year of adoption unless ratified by shareholders. Political Contributions and Lobbying Expenditure Oversight and Disclosure The Corporate Governance and Business Ethics Committee reviews and approves an annual report on political activities, contributions and lobbying expenses. It monitors and evaluates the Company’s ongoing political strategy as it relates to overall public policy objectives for the next year and provides guidance to the Board. We provide on our website a description of our oversight process for political contributions and a summary of Political Action Committee, or PAC, contributions. We also disclose semiannual information on dues, assessments and contributions of $10,000 or more to trade associations andtax-exempt advocacy groups and a summary of Company policies and procedures for political activity. This disclosure is available at www.prudential.com/governance under the heading “Political Activity & Contributions.” | The 2021 CPA-Zicklin Index of Corporate Political Disclosure and Accountability ranked Prudential as a Trendsetter company, the highest distinction. This is the seventh consecutive year that Prudential has been recognized for its disclosure, accountability, and political spending oversight. |

| | | | 24 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | | | | Corporate Governance | |

|

The 2018

CPA-Zicklin Index of Corporate Political Disclosure and Accountability ranked Prudential as a Trendsetter company, the highest distinction. This is the fourth consecutive year that Prudential has been recognized for its disclosure, accountability, and political spending oversight.

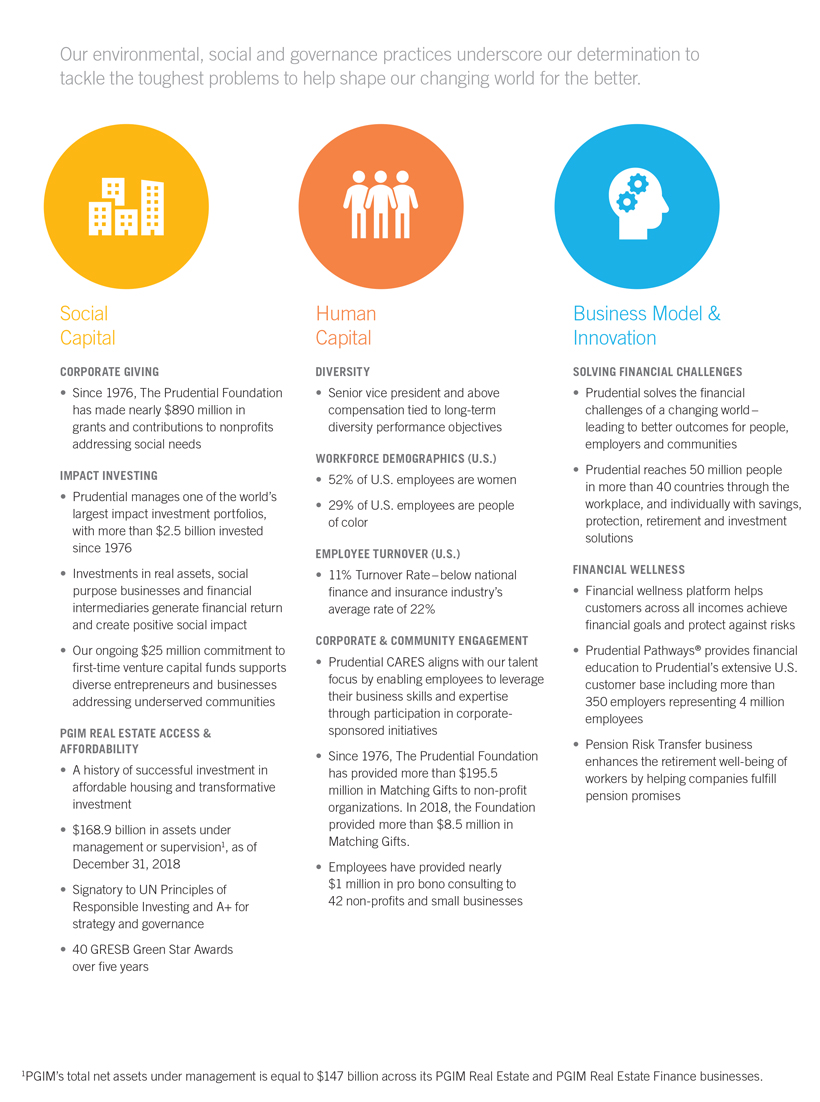

Environmental, Sustainability and Corporate Social Responsibility The Corporate Governance and Business Ethics Committee has oversight of environmental and climate issues and policies. In addition, three of our independent Board members sit on the Board’sour Corporate Social Responsibility Oversight Committee. These directors informThis Committee, in addition to inclusion and diversity, oversees the Company’s social responsibility efforts in impact investing, for financial and social returns, strategic philanthropy, employee engagement and corporate community involvement. 2018 investmentsOur 2021 activities in these areas include:

$273 million in impact investments to non-profits and businesses that seek to create both a financial and social return. $52.5 million in grants to nonprofit organizations through The Prudential Foundation. $24.4 million in corporate contributions to non-profit organizations, including more than $5 million in projects serving U.S. veterans. More than 92,000 volunteer hours by U.S. Prudential employees impacting local communities across the country.

| | | | | | | | 28

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | |

| | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

25 |

Item 2 Item 2–Ratification of the Appointment of the Appointment of the

Independent Registered Public Accounting Firm |

The Audit Committee of the Board has appointed PricewaterhouseCoopers LLP (“PricewaterhouseCoopers” or “PwC”) as the Company’s independent registered public accounting firm (“independent auditor”) for 2019.2022. We are not required to have the shareholders ratify the selection of PricewaterhouseCoopers as our independent auditor. We nonetheless are doing so because we believe it is a matter of good corporate practice. If the shareholders do not ratify the selection, the Audit Committee will reconsider whether or not to retain PricewaterhouseCoopers but may nevertheless retain it as the Company’s independent auditor. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interest of Prudential Financial and its shareholders. Representatives of PricewaterhouseCoopers will be present at the Annual Meeting and will have the opportunity to make a statement and be available to respond to appropriate questions by shareholders. FEES PAID TO PRICEWATERHOUSECOOPERSFees Paid to PricewaterhouseCoopers

The following is a summary and description of fees for services provided by PricewaterhouseCoopers in 20182021 and 2017.2020. Worldwide Fees (in millions) | | | | | | | | | | | | | Service | | 2018 | | | 2017 | | | | | Audit(1) | | $ | 52 | | | $ | 52 | | | | | Audit-Related(2) | | $ | 6 | | | $ | 5 | | | | | Tax(3) | | $ | 3 | | | $ | 3 | | | | | All Other(4) | | | — | | | $ | 1 | | | | | Total | | $ | 61 | | | $ | 61 | |

| | | | | | | | Service | | 2021 | | | 2020 | Audit (1) | | $ | 54 | | | $ 55 | Audit-Related (2) | | $ | 10 | | | $ 8 | Tax (3) | | $ | 2 | | | $ 2 | All Other | | $ | 0 | | | $ 0 | Total | | $ | 66 | | | $ 65 |

| (1) | The aggregate fees for professional services rendered for the integrated audit of the consolidated financial statements of Prudential Financial and, as required, audits of various domestic and international subsidiaries, the issuance of comfort letters, agreed-upon proceduresattest services required by regulation, consents and assistance with review of documents filed with the SEC. |

| (2) | The aggregate fees for assurance and related services, including internal control and financial compliance reports, agreed-upon proceduresattest services not required by regulation, and accounting consultation on new accounting standards, acquisitions and potential financial reporting requirements. |

| (3) | The aggregate fees for services rendered for tax return preparation, tax advice related to mergers and acquisitions and other international, federal and state projects and requests for rulings. In each of 2017 and 2018,2021, tax compliance and preparation fees totaled approximately $2$1.3 million and tax advisory fees totaled approximately $1$0.4 million. In 2020, tax compliance and preparation fees totaled approximately $1.5 million and tax advisory fees totaled approximately $0.5 million. |

(4) | The aggregate fees for all other services rendered, including for 2017 fees for business advisory services.

|

PricewaterhouseCoopers also provides services to domestic and international mutual funds and limited partnershipsinvestment vehicles, not consolidated by Prudential Financial, but which are managed by Prudential Financial. PricewaterhouseCoopers identified fees related to audit, audit-related, tax and all other services paid by these entities of $15$27 million in 20182021 and $14$25 million in 2017.2020. The Audit Committee has advised the Board of Directors that in its opinion thenon-audit services rendered by PricewaterhouseCoopers during the most recent fiscal year are compatible with maintaining its independence. PwCPricewaterhouseCoopers has been the Company’s independent auditor since it became a public company in 2001 and prior to that, from 1996.

| | | | 26 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

| | |

| | 29

|

| | |

| | Item 2—2 Ratification of the Appointment of the Independent Registered Public Accounting Firm | |

|

In determining whether to reappoint the independent auditor, the Audit Committee annually considers several factors, including:

the length of time the firm has been engaged;

the firm’s independence and objectivity;

PwC’s capability and expertise in handling the breadth and complexity of Prudential’s global operations, including the expertise and capability of the lead audit partner;

historical and recent performance, including the extent and quality of PwC’s communications with the Audit Committee, and the results of a management survey of PwC’s overall performance;

data related to audit quality and performance, including recent PCAOB inspection reports on the firm; and

the appropriateness of PwC’s fees, both on an absolute basis and as compared with its peers.

| | | | In determining whether to reappoint PwC as Prudential Financial’s independent auditor, the Audit Committee annually considers several factors, including: | ● the length of time the firm has been engaged; ● the firm’s independence and objectivity; ● the firm’s capability and expertise in handling the breadth and complexity of Prudential’s global operations, including the expertise and capability of the Lead Audit Partner; ● the extent and quality of the firm’s communications with the Audit Committee; | | ● the results of a management survey of PwC’s overall performance; ● other data related to audit quality and performance, including recent Public Company Accounting Oversight Board (“PCAOB”) inspection reports; and ● the appropriateness of the firm’s fees, both on an absolute basis and as compared with the Company’s peers. |

In accordance with SECSecurities and Exchange Commission (“SEC”) rules, independent audit partners are subject to rotation requirements limiting their number of consecutive years of service to our Company to no more than five. TheAs a result, in 2021, Prudential’s Audit Committee oversaw a rigorous process forof selecting the Company’sa new Lead Audit Partner with PwC. PwC provided a list of qualified potential lead audit partner includes Companypartners and the candidates were assessed based on their related experience and industry expertise. Interviews were conducted by senior management and the Audit Committee Chair vettingmet with and interviewed the independent auditor’s candidates.final candidate. The fullnew Lead Audit Partner selected was approved by the Audit Committee is consulted in connection with the final selectionand will assume oversight of the leadexternal audit partner.of Prudential Financial effective for the 2022 audit. AUDIT COMMITTEEAudit Committee PRE-APPROVALPre-Approval POLICIES AND PROCEDURESPolicies and Procedures

The Audit Committee has established a policy requiring itspre-approval of all audit and permissiblenon-audit services provided by the independent auditor. The policy identifies the guiding principles that must be considered by the Audit Committee in approving services so that the independent auditor’s independence is not impaired; describes the Audit, Audit-Related, Tax and All Other services that may be provided and thenon-audit services that may not be performed; and sets forth thepre-approval requirements for all permitted services. The policy provides for the generalpre-approval of specific types of Audit, Audit-Related and Tax services and a limited fee estimate range for such services on an annual basis. The policy requires specificpre-approval of all other permitted services. The independent auditor is required to report periodically to the Audit Committee regarding the extent of services provided in accordance with theirpre-approval and the fees for the services performed to date. The Audit Committee’s policy delegates to its Chair the authority to address requests forpre-approval of services with fees up to a maximum of $250,000 between Audit Committee meetings if the Company’s Chief Auditor deems it reasonably necessary to begin the services before the next scheduled meeting of the Audit Committee, and the Chair must report anypre-approval decisions to the Audit Committee at its next scheduled meeting. The Audit Committee may not delegate to management the Audit Committee’s responsibility topre-approve permitted services of the independent auditor. All Audit, Audit-Related, Tax and All Other services described above were approved by the Audit Committee before services were rendered. | The Board of Directors recommends that shareholders vote “FOR” ratification of the appointment of PricewaterhouseCoopers as the Company’s Independent Auditor for 2022. |

The Board of Directors recommends that shareholders vote“FOR” ratification of the appointment of PricewaterhouseCoopers as the Company’s Independent Auditor for 2019.

| | | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | 27 |

ENHANCING COMMUNICATION THROUGH AUDIT COMMITTEE REPORTING

The Center for Audit Quality and a group of nationally recognized U.S. corporate governance and policy organizations jointly released a paper entitled “Enhancing the Audit Committee Report: A Call to Action,” which encouraged audit committees of public companies to proactively consider strengthening their public disclosures to more effectively convey the critical work of audit committees to investors and stakeholders. Prudential was featured as an example of a company exhibiting voluntary practices strengthening audit committee disclosures.

| | | | | | | | 30

| | |

| | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement |

| | |

| | Item 2—2 Ratification of the Appointment of the Independent Registered Public Accounting Firm | |

|

REPORT OF THE AUDIT COMMITTEEReport of The Audit Committee

ThreeFour independent directors comprise the Audit Committee. The Committee operates under a written charter adopted by the Board.

In addition, the Board has determined that all of our Audit Committee members, Messrs. Paz and Scovanner and Ms.Mses. Hund-Mejean and Jones, satisfy the financial expertise requirements of the NYSE and havethat each of Messrs. Paz and Scovanner and Mses. Hund-Mejean and Jones has the requisite experience to be designated an audit committee financial expert as that term is defined by rules of the SEC. Management is responsible for the preparation, presentation and integrity of the financial statements of Prudential Financial and for maintaining appropriate accounting and financial reporting policies and practices, andas well as internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Prudential Financial’s independent auditor, PricewaterhouseCoopers, is responsible for auditing the consolidated financial statements of Prudential Financial and expressing an opinion as to their conformity with generally accepted accounting principles, as well as expressing an opinion on the effectiveness of internal control over financial reporting in accordance with the requirements of the Public Company Accounting Oversight Board (“PCAOB”).PCAOB. In performing its oversight function, the Audit Committee reviewed and discussed the audited consolidated financial statements of Prudential Financial as of and for the year ended December 31, 20182021 and Management’s Annual Report on Internal Control Over Financial Reporting with management and Prudential Financial’s independent auditor. The Audit Committee also discussed with Prudential Financial’s independent auditor the matters required to be discussed by the independent auditor with the Audit Committee under the rules adopted by the PCAOB.PCAOB and the SEC, including the independent auditor’s communication of its Audit Report to the Audit Committee. This report includes critical audit matters, which are audit matters that were communicated or required to be communicated to the Audit Committee relating to accounts or disclosures that are material to Prudential Financial’s financial statements and that involved especially challenging, subjective or complex auditor judgment. The Audit Committee received from the independent auditor the written disclosures and the letters required by applicable requirements of the PCAOB regarding the independent auditor’s communications with the Audit Committee concerning independence and has discussed with the independent auditor its independence. The Audit Committee has discussed with, and received regular status reports from, Prudential Financial’s Chief Auditor and independent auditor on the overall scope and plans for their audits of Prudential Financial, including their scope and plans for evaluating the effectiveness of internal control over financial reporting. The Audit Committee meets with the Chief Auditor and the independent auditor, with and without management present, to discuss the results of their respective audits, in addition to private meetings with the Chief Financial Officer, Chief Risk Officer, General Counsel, Chief Actuary and Chief Compliance Officer. In determining whether to reappoint PricewaterhouseCoopers as Prudential Financial’s independent auditor, the Audit Committee took into consideration a number of factors, including the length of time the firm has been engaged, the firm’s independence and objectivity, PwC’s capability and expertise in handling the breadth and complexity of Prudential’s global operations, including the expertise and capability of the Lead Audit Partner, historical and recent performance, including the extent and quality of PwC’s communications with the Audit Committee, the results of a management survey of PwC’s overall performance, data related to audit quality and performance, including recent PCAOB inspection reports on the firm, and the appropriateness of PwC’s fees, both on an absolute basis and as compared with itsPrudential Financial’s peers. Based on the reports and discussions described in this report and subject to the limitations on the roles and responsibilities of the Audit Committee referred to above and in its Charter, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements of Prudential Financial and Management’s Annual Report on Internal Control Over Financial Reporting be included in the Annual Report on Form10-K for the fiscal year ended December 31, 20182021 for filing with the SEC. THE AUDIT COMMITTEEThe Audit Committee

Martina Hund-Mejean (Chair) Wendy E. Jones George Paz Douglas A. Scovanner (Chair) Martina Hund-Mejean

George Paz

| | | | | | | | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

| | |

| | 31

|

| | |

28 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | |

| | Item 3 Advisory Vote to Approve Named Executive Officer Compensation |

Item 3–Advisory Vote to Approve

Named Executive Officer Compensation

The Board is committed to excellence in governance and recognizes our shareholders’ interest in our executive compensation program. As a part of that commitment, and in accordance with SEC rules, our shareholders are being asked to approve anon-binding nonbinding advisory resolution on the compensation of our named executive officers, as reported in this Proxy Statement. This proposal, commonly known as a “Say on Pay” proposal, gives shareholders the opportunity to endorse or not endorse our 20182021 executive compensation program and policies for our named executive officers through the following resolution: RESOLVED, that the shareholders of Prudential approve, on an advisory basis, the compensation of the Company’s named executive officers set forth in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables and narrative in this Proxy Statement. This vote is not intended to address any specific item of compensation, but rather our overall compensation policies and practices relating to our named executive officers. Accordingly, your vote will not directly affect or otherwise limit any existing compensation or award arrangement of any of our named executive officers. Because your vote is advisory, it will not be binding upon the Board. The Board and the Compensation Committee will, however, as it hasthey have done in prior years, take into account the outcome of the “Say on Pay” vote when considering future compensation arrangements. At the 2017 Annual Meeting, shareholders approved, on an advisory basis, holding “Say on Pay” votes annually, and the Board has adopted a policy providing for annual “Say on Pay” votes. Accordingly, the next “Say on Pay” vote will occur in 2020.2023. The Board of Directors recommends that shareholders vote“FOR” the advisory vote to approve our named executive officer compensation.

| | | | The Board of Directors recommends that shareholders vote “FOR” the advisory vote to approve our named executive officer compensation. |

| | | 32

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT | | |

| | Notice of Annual Meeting of Shareholders and 2019 Proxy Statement

29 |

Item 4–Shareholder Proposal RegardingItem 4 Shareholder Proposal to Adopt the Right to Act by Written Consent

|

In accordance with SEC rules, we have set forth below a shareholder proposal, along with the supporting statement of the shareholder proponent. The Company is not responsible for any inaccuracies it may contain. The shareholder proposal is required to be voted on at our Annual Meeting only if properly presented. As explained below, our Board unanimously recommends that you vote“AGAINST” the shareholder proposal. John Chevedden, 2215 Nelson Avenue, No. 205, Redondo Beach, California, 90278, beneficial owner of 5080 shares of Common Stock, is the proponent of the following shareholder proposal. The proponent has advised us that a representative will present the proposal and related supporting statement at the Annual Meeting. Proposal 4—Shareholder Right to Act by Written Consent Resolved, Shareholders request that our board of directors undertake suchtake the necessary steps as may be necessary to permit written consent by the shareholders entitled to cast the minimum number of votes that would be necessary to authorize the action at a meeting at which all shareholders entitled to vote thereon were present and voting. This written consent is to be consistent with applicable law and consistent with giving shareholders the fullest power to act by written consent consistent with applicable law. This includes shareholder ability to initiate any topic for written consent consistent with applicable law.

Hundreds of major companies enable shareholder action by written consent. This proposal topic won majority shareholder support at 13 large companies in a single year. This included 67%-support at both Allstate and Sprint. This proposal topic also won 63%-support at Cigna Corp. in 2019. This proposal topic would have received higher votes than 63% to 67% at these companies if more shareholders had access to independent proxy voting advice. This proposal topic also won 85% support at the 2021 Conagra annual meeting without any special effort by the proponent. Taking action by written consent in place of a meeting is also a means shareholders can use to raise important matters outside the normal annual meeting cycle.cycle like the election of a new director. For instance the replacement of the director who received the most against votes. Mr. Thomas Baltimore received 67 million against votes in 2021 which equaled a negative percentage of 29%. This proposal topic won majority shareholder support at 13 major companieswas up to 40-times the negative votes of other Prudential directors. Mr. Charles Lowrey, Prudential Chairman and CEO, received the third highest negative votes of any Prudential director in a single year. This included 67%-support at both Allstate and Sprint. Hundreds of major companies enable shareholder action by written consent. This proposal topic would2021. If shareholders have received a vote still higher than 67% at Allstate and Sprint if all shareholders at Allstate and Sprint had access to independent proxy voting advice. More than 100 Fortune 500 companies provide for shareholders to call special meetings andthe right to act by written consent. Written consent, Mr. Baltimore and Prudential may be inspired to correct the factors behind Mr. Baltimore’s against votes and other directors might avoid getting in the situation Mr. Baltimore is a means to elect a director who could focus on the wisdom of stock repurchases:

Approved share repurchase plan of up to $1.5 Billion of common stock starting January 1, 2018

Approved share repurchase increase of $500 Million of common stock August 2016

There is a concern about share repurchases like the above. Stock buybacks can be a sign of short-termism for executives—sometimes boosting share price without boosting the underlying value, profitability, or ingenuity of the company. A dollar spent repurchasing a share is a dollar that cannot be spent on new equipment, an acquisition, entry into a new market or anything else.

Written consent is a means to elect a director who could focus on avoiding reoccurrences of events like these:

Putative Class Action Lawsuit over alleged improper charges on universal life policies holders to “cure defaults and/or reinstate lapses,” Pruco Life Insurance Company

May 2018

Regulator launched investigation over alleged role in Wells Fargo’s fraudulent accounts

December 2017

Criticism over alleged role in offshore tax havens

April 2017

The expectation is that, once this proposal is adopted, shareholders would not need to make use of this right of written consent because its mere existence will act as a guardrail to help ensue that our company is well supervised by the Board of Directors and management. Our Directors and management will want to avoid shareholder action by written consent and will thus be more alert in avoiding poor performance.in.

Please vote yes:Shareholder Right to Act by Written Consent—Proposal 4

| | | | 30 | | NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND 2022 PROXY STATEMENT |

| | | | | | | Item 4 Shareholder Proposal to Adopt the Right to Act by Written Consent | |

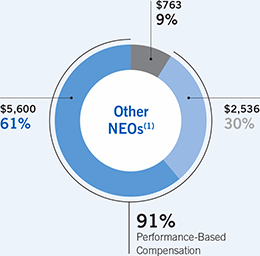

|